IRS Announces Filing Season Start Date

Late yesterday afternoon, the Internal Revenue Service issued a press release revealing that January 28 will officially kick off the 2019 filing season.…

Late yesterday afternoon, the Internal Revenue Service issued a press release revealing that January 28 will officially kick off the 2019 filing season.…

February 4, 2019 will mark the end of the Internal Revenue Service faxing tax transcripts to individuals and tax professionals. According to the IRS Newswire, tax industry feedback helped contribute to the decision to stop the practice.…

Read more about IRS Will Not Fax Tax Transcripts after February

According to the Internal Revenue Service, there are two new “business email compromise/business email spoofing (BEC/BES)” spear-phishing scams targeting tax professionals: the direct-deposit scam and the wire-transfer scam.…

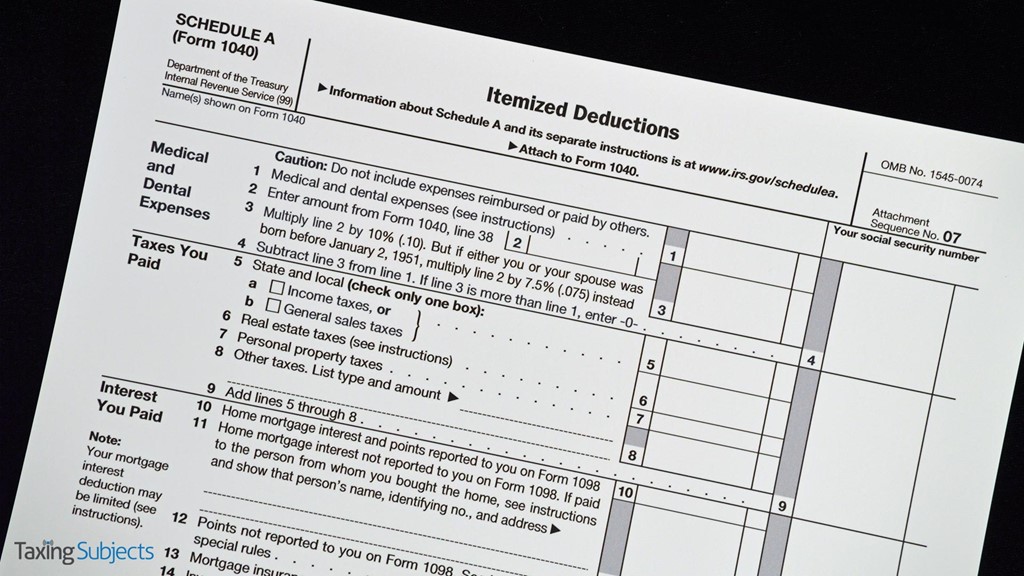

The tax reform package that went into effect at the end of 2017 effectively doubled the standard deduction for individuals.…

Read more about Tax Reform Likely to Result in Fewer Taxpayers Who Itemize

The Government Accountability Office recently audited the Internal Revenue Service’s financial statements for the 2017 and 2018 fiscal years.…

The Internal Revenue Service says it is expanding the role of one of its advisory committees, by combining it with two other advisory panels.…

The Internal Revenue Service has scheduled three national webinars giving tax professionals an overview of the tax reform changes they’ll face in the coming 2019 tax season.…

The “Future State” initiative debuted in 2014 and featured an online portal that allowed taxpayers to communicate with the IRS and to deal with their taxes online.…

Read more about IRS Future State Shifted to Part of Five-Year Plan

While too much rain due to tropical storms and hurricanes has been the big news in the eastern U.S. recently, out west, the problem has been not enough rain. Many farmers and ranchers have had to sell off their herds of livestock because of the dry conditions.…

Read more about More Time to Replace Livestock due to Drought

While the Tax Cuts and Jobs Act removed the deduction for entertainment that many businesses enjoyed in years past, the IRS announced Notice 2018-76, which outlines when business owners can deduct half of the price tag for business meals.…