IRS Issues Guidance on Cooperatives

The Internal Revenue Service and the Treasury Department have issued their legal guidance on certain deductions to cooperatives and their patrons.…

The Internal Revenue Service and the Treasury Department have issued their legal guidance on certain deductions to cooperatives and their patrons.…

The April filing deadline is long gone, but that doesn’t stop scammers from attempting to swindle American taxpayers out of their hard-earned money.…

A new audit shows large-scale businesses are largely drawing a pass if they under-report their income. The examination revealed that few accuracy-related penalties are proposed by IRS examiners in large-business examinations, and if they are, those penalties are generally not upheld on appeal.…

Read more about Large Businesses Often Escape Accuracy Penalty

Some of your clients may have found a tax bill when they opened their mailbox this morning. That’s because the Internal Revenue Service began sending CP14 and CP501 Notices to taxpayers who still owe tax for TY 2018.…

We invited Jim Lowe, EA to the Taxing Subjects Podcast studio to discuss how his filing season went. This episode coincides with the “How Did Your Filing Season Go?” survey that we sent to more than 5,000 tax professionals around the country.…

Read more about Jim Lowe, EA Discusses the 2019 Filing Season – E28

This filing season was the first to feature almost all changes from to the Tax Cuts and Jobs Act—not to mention the new Form 1040 and Schedules 1 through 6. To learn whether these changes had a significant impact on tax professionals, Taxing Subjects surveyed more than 5,000 preparers.…

Read more about “How Did Your Filing Season Go?” Survey Results

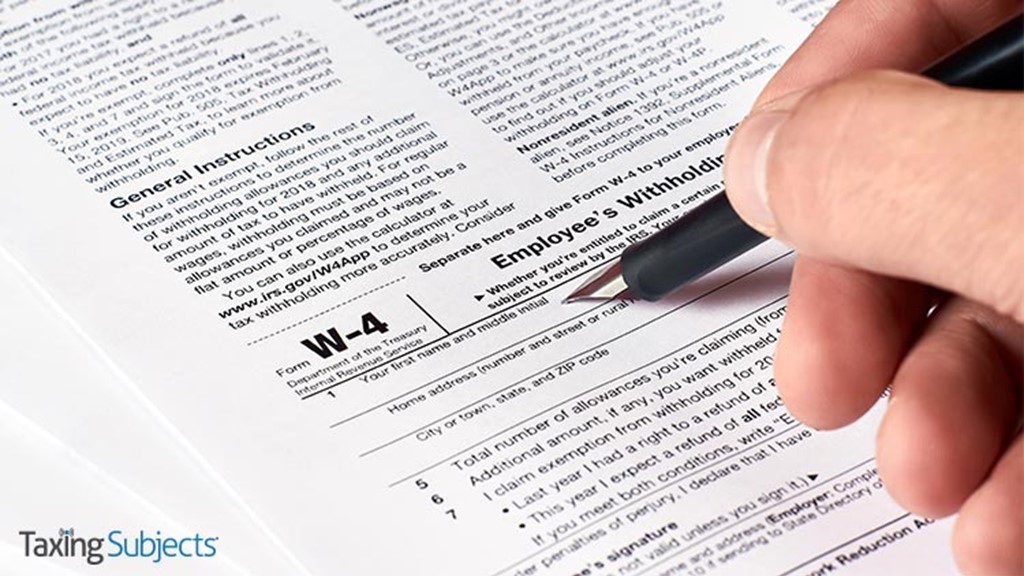

The Internal Revenue Service has unveiled a revised Form W-4, issuing a draft of the form for 2020. The changes, they say, will make accurate withholding choices easier for employees.…

It’s no secret that running a successful small business isn’t easy. The Internal Revenue Service reminds small-business owners that they may qualify for a home office deduction that can help their bottom line and give them one less thing to worry about.…

Read more about Home Office Deduction Can Help Small Businesses

Tax professionals interested in learning more about the Section 199A qualified business income (QBI) deduction can attend a webinar hosted by the IRS tomorrow afternoon.…

May is National Historic Preservation Month, and plenty of organizations around the U.S. are promoting historic buildings and other important heritage sites around the country.…