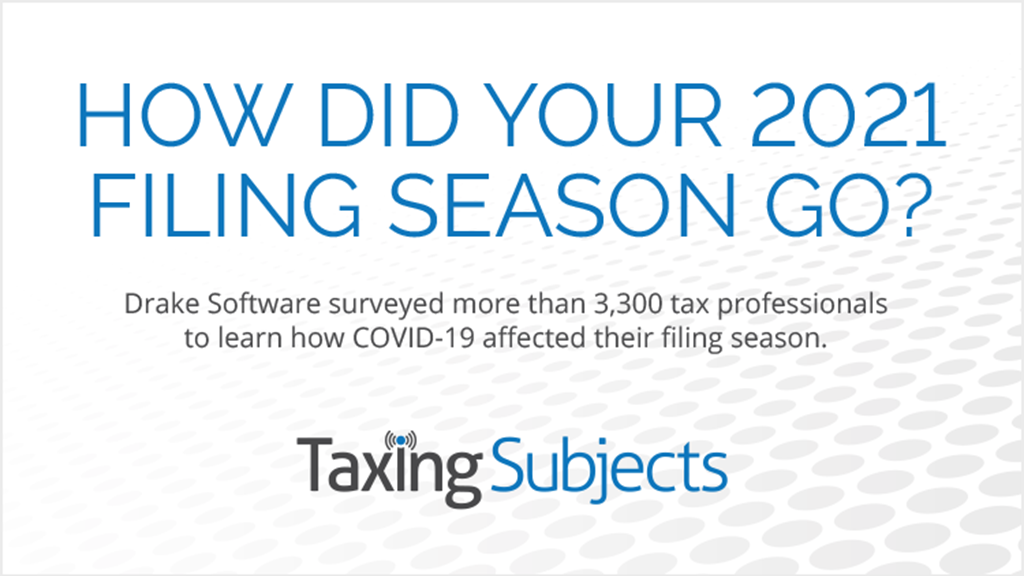

Drake Software How Did Your 2021 Filing Season Go? Infographic

Drake Software for the third year in a row surveyed tax professionals about their experience during filing season. More than 3,000 respondents completed the survey, a group comprised of attorneys, CPAs, EAs, and non-credentialed preparers.…

Read more about Drake Software How Did Your 2021 Filing Season Go? Infographic