Final Regs Issued for Transportation, Commuting Expense; Some QOF Filers to Get Letters from IRS

Final regulations have been issued on the deduction for qualified transportation fringe and commuting expense.…

Final regulations have been issued on the deduction for qualified transportation fringe and commuting expense.…

The tax-filing season will be upon us before we know it, so the Internal Revenue Service is urging taxpayers to take actions now to help ensure they can file timely and accurate returns in 2021.…

Read more about What’s New, What to Consider When Filing in 2021

While it seems our world is on the edge of big changes for the coming year, the IRS is keeping some things status-quo for now. The Internal Revenue Service says interest rates will be the same for the calendar quarter that starts Jan. 1, 2021.…

Read more about Interest Rates the Same for 2021’s First Quarter

The Internal Revenue Service is giving employers a friendly nudge to remind them that their Forms W-2 and other wage statements have to be filed by Feb. 1, 2021, to avoid penalties.…

Read more about 2021 Deadline for W-2s Closer Than You Think

The Internal Revenue Service is pairing up with a Virginia research firm in an effort to improve the agency’s procurement operations.…

Read more about IRS Teams with Research Firm to Smooth Procurement Process

The Internal Revenue Service Advisory Council, also known as IRSAC, has come out with its annual report for 2020. The 195-page report includes recommendations to the IRS on new and continuing issues in tax administration.…

Read more about IRS Advisory Council Issues 2020 Annual Report

With 2020’s extended tax deadlines due to the coronavirus pandemic, it seems like we just wrapped up the previous tax season. But believe it or not, the next filing season kicks off Jan. 1, 2021.…

Read more about Get Started Now to Make Next Tax Season Easier

Fiscal Year 2020 was a very busy—and productive—year for the IRS’ Criminal Investigations unit. The just-released annual report for CI Division touts the unit’s identification of more than $10 billion in tax fraud and other financial crimes, despite the limitations of the COVID-19 pandemic.…

Read more about IRS Investigators Make Big Advances in a Busy 2020

After Dec. 12, business tax transcripts will soon be a little less informative—for good reason. The IRS will start masking sensitive data on the transcripts to protect businesses from identity theft beginning Dec. 13.…

Read more about IRS to Mask Key Details on Business Transcript

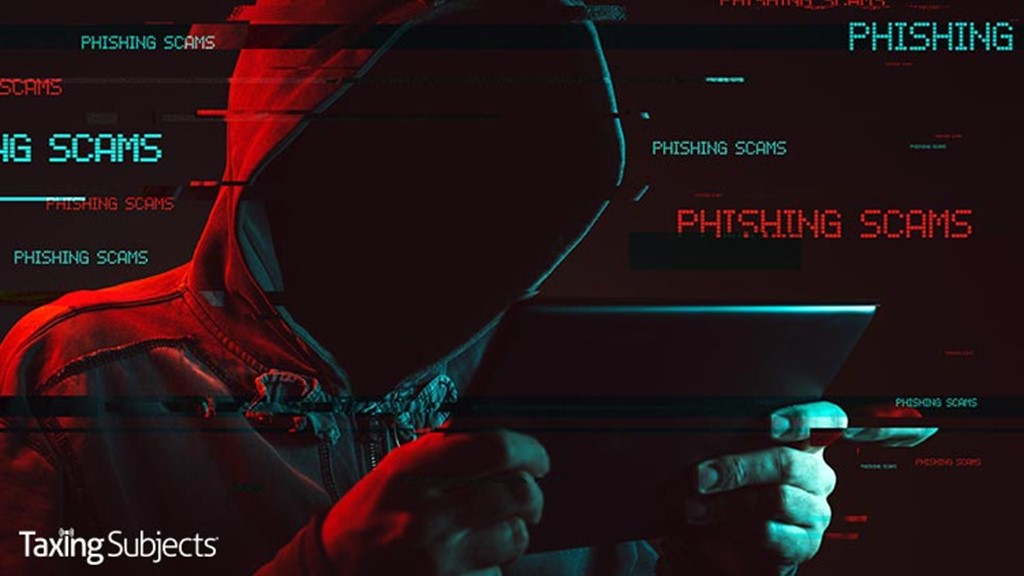

Identity thieves who deploy phishing scams are quick to innovate, using popular communication platforms and current events to target victims where and when they are most vulnerable.…

Read more about Protecting Your Tax Practice from Phishing Scams