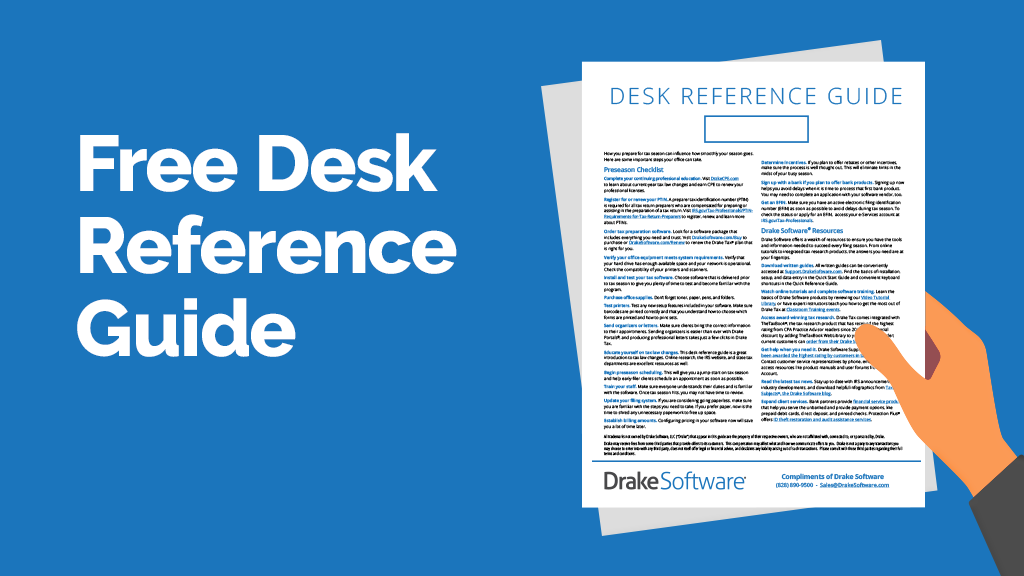

Drake Software Desk Reference Guide for Tax Year 2025: Version Two

Because IRS guidance continues to evolve, portions of the current Desk Reference Guide may change. We are monitoring developments closely to ensure accuracy. Learn more.…

Read more about Drake Software Desk Reference Guide for Tax Year 2025: Version Two