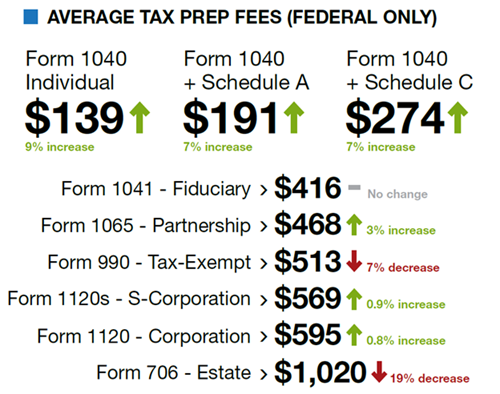

2017 "How Do Your Tax Prep Fees Stack Up?" Results

Drake Software Surveyed 2,800 Tax Professionals

Drake Software conducted the second in a series of bi-annual surveys of tax professionals—How Do Your Tax Prep Fees Stack Up?—to measure changes in the average cost for preparing tax returns, ranging from standard Forms 1040 to fiduciary, tax-exempt, and estate returns. The survey of more than 2,800 respondents included EAs, CPAs, attorneys, and non-credentialed tax preparers from rural, suburban, urban, and out-of-the-country markets.

2017-How-Do-Your-Tax-Prep-Fees-Stack-Up.pdfWhat Were the Differences Between 2015 and 2017?

When comparing this year to the 2015 data, the previous survey had more than 7,000 respondents. Despite this difference, most pricing trends went as expected: a gradual, low-percentage increase.

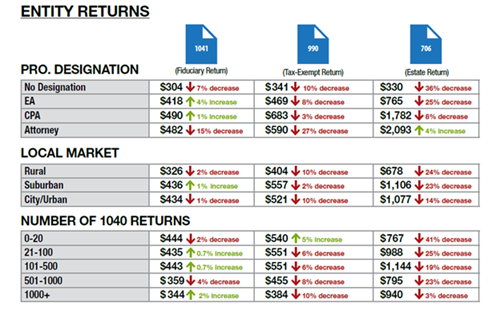

The major surprise came from tax-exempt and estate returns, the vast majority of which saw significant decreases. Foreshadowed by an overall decrease of 19%, estate returns had the most significant drop depending

When filtering by professional designation, non-credentialed and EA fees for Forms 706 dropped by 36% and 25%, respectively, and CPA prices fell by 8%. Only attorneys saw a meager increase (4%) over data from the 2015 survey. Market-specific results told a similar story: rural and suburban prices for Forms 706 decreased by almost 25%, and attorney fees were 14% less than 2015.

These significant drops in price could be the result of a smaller sample, or there could be contributing factors not accounted for in the survey. Given the normal trends in 1040-related returns, the significant changes for Forms 990 and 706 are curious.

So we’ll throw it to the readers: If you dropped your fees for tax-exempt or estate returns, comment below. Maybe you can help shed light on this surprising trend.

TO ACCESS YOUR FREE DOWNLOAD

- Complete the form below

- Wait for the page to refresh

- Click the hyperlink that appears below these instructions

Important: After completing the form, you will have access to all Taxing Subjects downloads!

Warning: If you clear your browser cookies, you will have to fill out this form again.