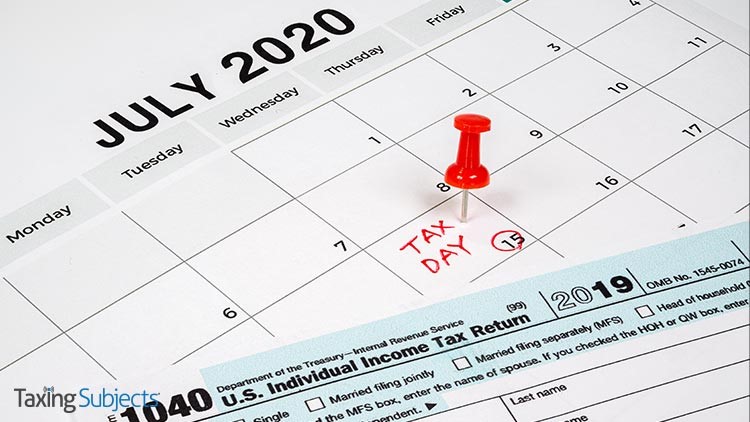

IRS Not Pushing Back July 15 Deadline

The Internal Revenue Service has some bad news for taxpayers hoping that the tax filing and payment deadlines would get pushed back again. In a recent IRS Newswire press release, the agency said taxpayers should either file their tax return or an extension by July 15.

What is the deadline for taxpayers who request an extension?

There are three important deadlines for taxpayers who want to get an extension:

- Request the extension by July 15, 2020

- Pay tax owed by July 15, 2020

- File the now-extended tax return by October 15, 2020

The IRS explained that there are two ways to secure an extension: file Form 4868 or pay tax owed. They also said that paying can “save a step” on July 15: “When getting an extension by making a payment, taxpayers do not have to file a separate extension form and will receive a confirmation number for their records.” Besides, missing the payment deadline can add penalties and interest to your tax bill.

How do I pay my tax bill?

The IRS suggested five ways to pay taxes: IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), third-party payment processors for debit and credit cards, a check or money order, or even a loan. Those who can’t pay all of what they owe can request a payment agreement—like an Online Payment Agreement, Installment Agreement Request, temporarily delayed collection, or an Offer in Compromise—which the agency said can mitigate potential penalties and interest.

“Though interest and late-payment penalties continue to accrue on any unpaid taxes after July 15, the failure to pay tax penalty rate is cut in half while an installment agreement is in effect,” the IRS explained. “The usual penalty rate of 0.5% per month is reduced to 0.25% for the calendar quarter beginning July 1, 2020, the interest rate for underpayment is 3%.”

What about state tax filing deadlines?

The IRS also noted that state tax filing deadlines could be different from the July 15 filing deadline. Check out our “Did COVID-19 Change My State Individual Income Tax Deadline” blog to double check your state deadline.

Source: IR-2020-134